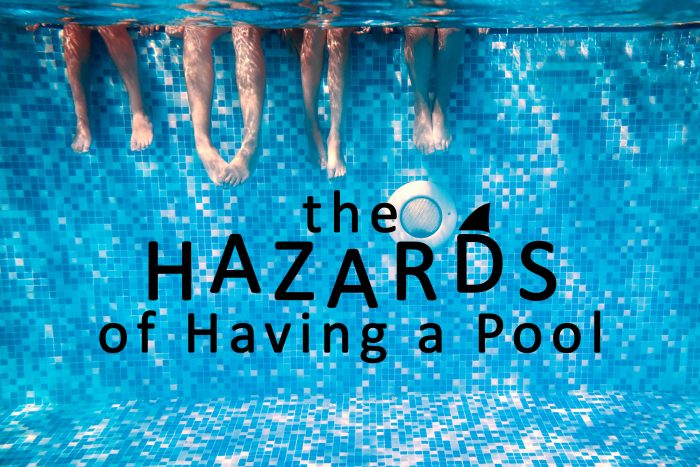

When you were younger, and it was summertime, not having school was the best thing. Hanging out for the day at the pool is every child’s favorite pastime. Remember being that young, and the biggest killjoy was hearing “No running by the pool!” from the nearest lifeguard.

Well, as you get older, you begin to understand the importance of slow-moving children on wet cement. The risks are way too high, and the liability falls on other people. If you have a pool, or you are considering getting a pool, it’s important to know what you’re getting yourself into when it comes to your homeowner’s insurance policy.

Having a pool comes with numerous risks, whether it be a child slipping and falling, or your teenager throwing a pool party and things getting rowdy. There’s a much higher chance someone could get injured on your property than on another property without a pool. If someone slips and falls, injuring their back, the medical expenses will create a very expensive claim for your insurance company to pay. Therefore, you’ll need higher liability limits on your policy, including an umbrella policy.

There’s always a chance someone could get hurt at your pool. To prevent paying the medical costs out of pocket, make sure your homeowner’s policy has sufficient enough coverage. Contact your agent for advice on your policy limits.